Is your 20+ Year Old Sengkang HDB Flat a Wealth Builder or a Retirement Trap?

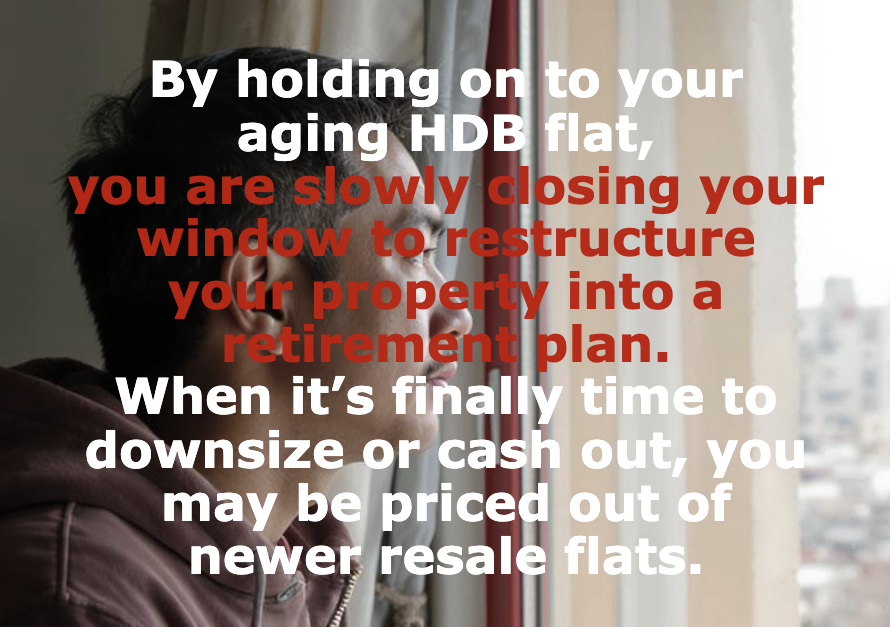

If your flat is over 20 years old, rising CPF interest, mortgage costs, and slowed resale value may quietly be eating into your retirement buffer.

Property Health Check Report

Claim your Free Property Health Check Report today to know if your HDB value has been eroded

The Hidden Financial Pressure You May Be Ignoring

- CPF Accrued Interest (2.5% P.A) quietly reduces your eventual profits

- Mortgage Interest (HDB Loan 2.6% or more for bank loan) is eating into your cash flow

- Stagnant HDB prices mean your quaity is not growing - but shrinking when adjust for inflation

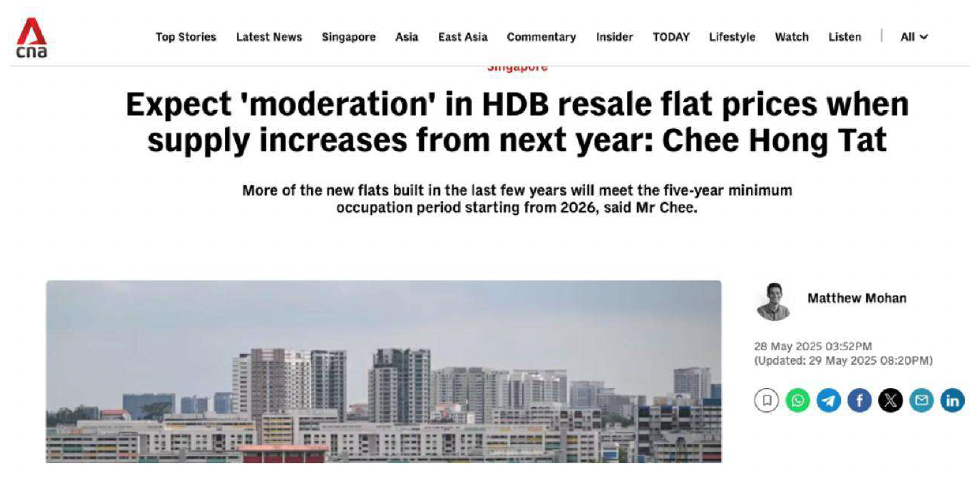

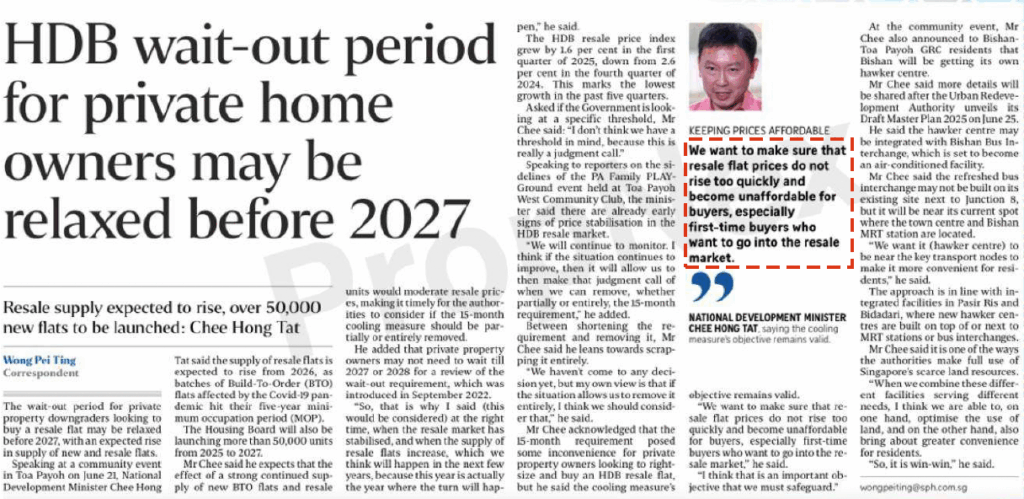

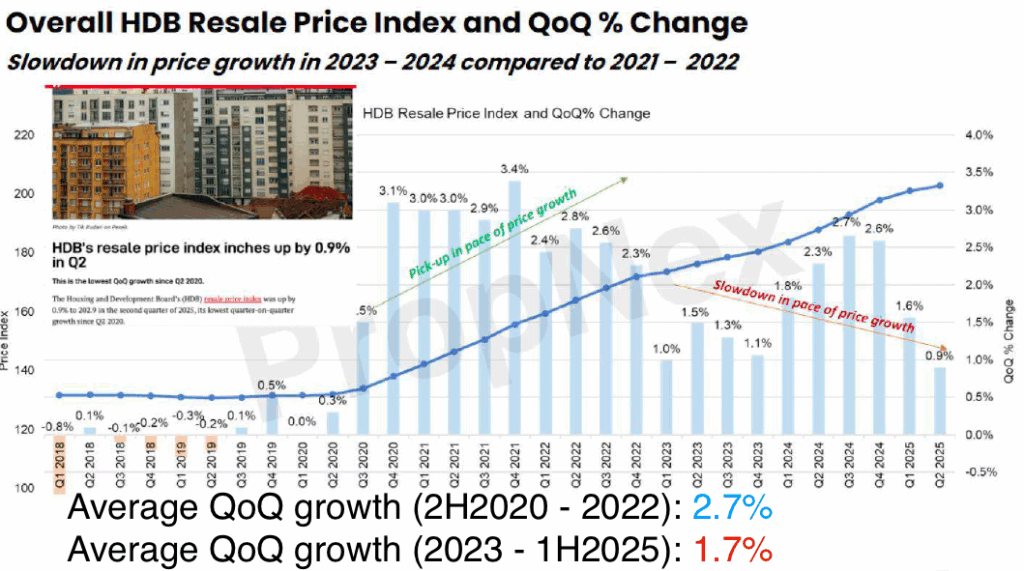

Will The Upward Trend Continue?

Many HDB flats have gained value after Covid-19 due to a rise in resale demand following delays in BTO constructions.

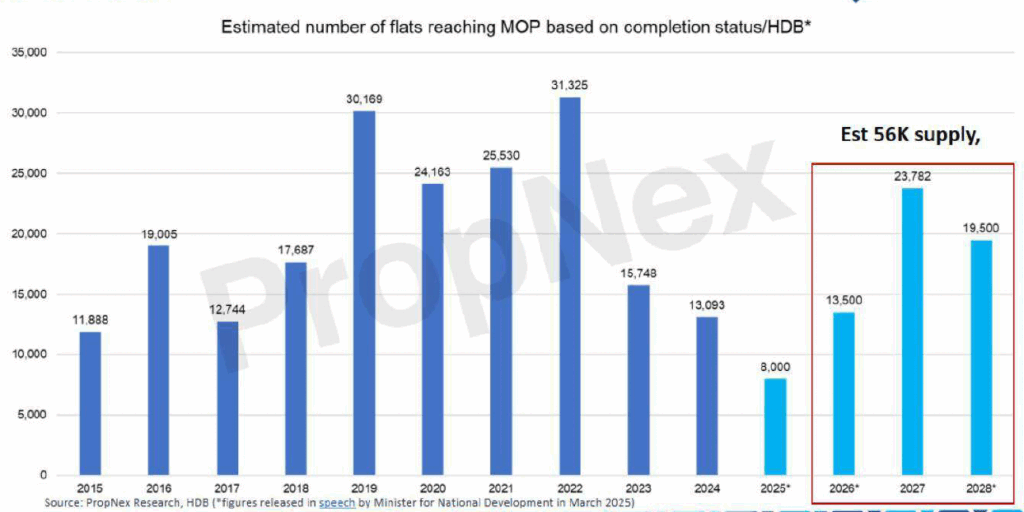

However, three years after Covid, construction progress has returned to normal. HDB is expected to launch about 140,000 flats from 2021 to 2027.

Will all these supply affect the HDB Resale Price?

Our Gov have already given the hint...

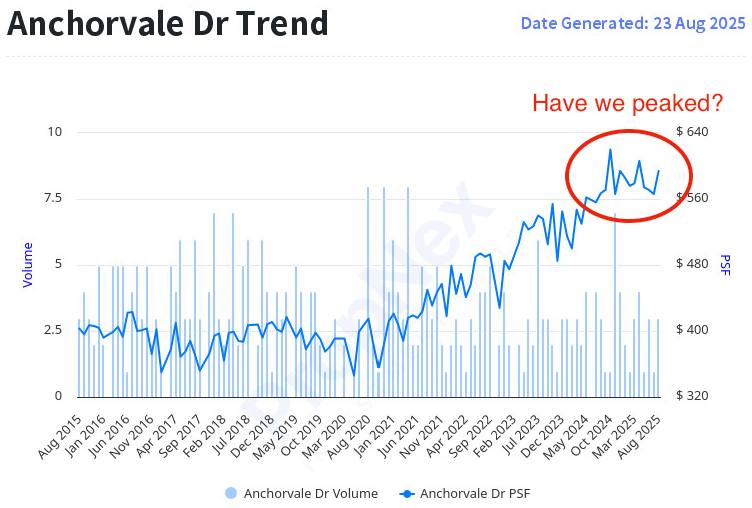

How has Anchorvale Drive HDB performed?

Will Your HDB Become Your Biggest Liability?

While your HDB may currently be worth more, as it ages, its value growth may slow down or decline. Using HDB loans and CPF for payments might lead to missing out on mortgage and CPF interest gains.

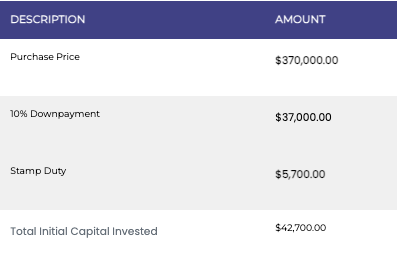

The table below use a 5 room HDB at Blk 645 Punggol Central as an example to show how different selling timing will affect your returns.

Let's say you purchased a 5 room HDB at Blk 645 Punggol Central at $370,000 in 2008. If you can turn back the time at which Sell Point will you sell your HDB or will you keep staying?

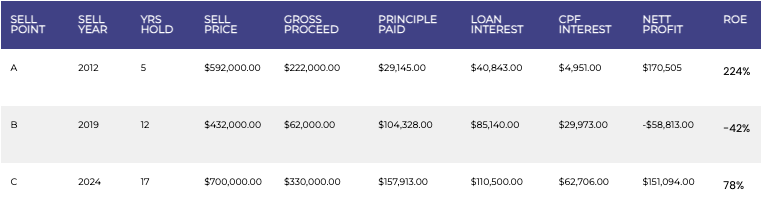

Most people will say Sell Point C because it's the highest transacted price. Well, let's break it down.

Sell Point A

- If you sell at this point. You might not get the highest selling price, but you paid the least loan and CPF Interest. Therefore your ROE is the highest among the 3 Sell Points. (Note: I did not use the highest selling price as a reference at Sell Point A because you cannot predict when it will be the peak. Nevertheless, the focus was on interest paid.)

Sell Point B

- Assuming you sold at a bad time and made a loss with -42% ROE. This example shows that HDB prices do not always follow an upward trend. We are currently still on the upward trend since COVID-19, due to the supply crunch. However, how well will your HDB price hold when HDB increases supplies and your flat ages?

Sell Point C

- The market turned around since Covid-19, and you got a lucky break and sold at the record price after holding for 17 years. But as your loan interest and CPF compounded interest build up, your ROE is lower than if you sell at Sell Point A. We have a lucky break, but even with inflation in place, the cost of land and construction is helping push up property prices. We cannot deny the fact that HDB is still a leasehold property. Their value will depreciate due to lease decay.

- Well, the good news you are also building capital as the CPF interest paid can be used for your next purchase. However, if you compare it to Sell Point A, you can purchase a newer property which might give you better growth, have a longer loan tenure which you have in lower installments, and make your money work harder for you.

With the growth start to slow down and forcasted increased in BTO launch means your HDB price might peaked.

Your Options - Before It's Too Late

- Right-size for cash equity while staying in the new neghborhood

- Upgrade to increase property value before CPF and loan limits change

- Sell and reinvest in higher-growth or income-producing assets

- Stay put - but only with a solid long-term plan

A Property Health Check

Can Determine Your Best Options

I will help you assess your flat's real value, CPF clawback impact and options to restructure your assets - Absolutely Free

Who Is Steven Chia?

I’m Steven Chia, a seasoned real estate consultant with years of experience helping Singaporean families secure their futures. I’ve seen too many people suffer from poor planning – my goal is to make sure you’re not one of them. Let’s work together to ensure your retirement is as comfortable and stress-free as possible.

Take the first step – Schedule your consultation today!

A Consistent Agent Who Produces Results

What Seven Chia's Clients Say...

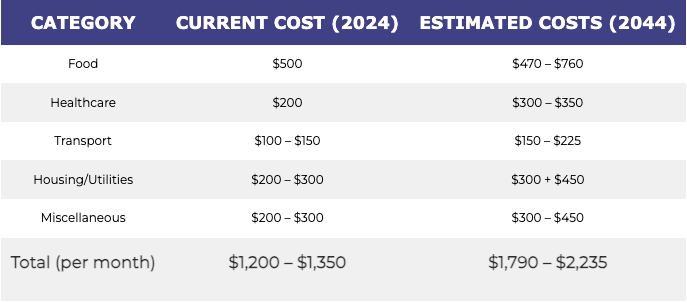

How Much Do You Really Need To Retire?

Have You Felt The Inflation?

When Economic Rice is not so economic. Recently, I got a plate of economic rice with one vegetable dish, one tofu, and one meat, and it cost me $6.30 at a food court in one of our General Hospitals.

I couldn’t help but think about how much I would need for retirement 20 years later.

Monthly Retirement Expenses in 2044 (Estimate)

Based on inflation-adjusted projections 25 years from now, you’ll likely need:

- Basic Lifestyle: SGD $2,200/month × 20 years = $528,000

- Moderate Lifestyle: SGD $2,800/month × 20 years = $672,000

- Comfortable Lifestyle: SGD $4,000/month × 20 years = $960,000+

CPF LIFE payouts (~$1,000–$1,400/month) will not be enough to match rising living and medical costs.

What happens then? Many retirees will need to rely on family support, move in with children, or cut back on lifestyle—giving up the retirement they worked so hard for.

Start Making Changes To Plan For Retirement

Get your free Property Health Report by filling up the form below

- Estimate the valuation of your HDB Flat (without visual assessment)

- Block Price Trend - How your block price trend

- 500M Similar Property Trend - How much did your neighbour within a 500m radius sell their flat

- Nearby Amenties - Understand your unique selling point

- Market asking price - to determine the highest asking price that will still attract Buyers

- Complimentary 1 hr meet up for financial assessment, options for your progression, and timeline planning.

Disclaimer on Personal Data

We value your privacy. Any personal data collected through this website (including but not limited to name, contact details, and email address) will be used strictly for the purpose of providing our services to you. Your information will not be shared, sold, circulated, or disclosed to any third party without your consent, unless required by law.

By using this website, you acknowledge and agree to this disclaimer.